About Global South Services

Global South Services was founded to provide investors with sound financial opportunities that will, in turn, help worthy companies thrive in emerging markets around the world. Our highly experienced team of professionals invests solely in businesses that are making a positive impact in the communities in which they operate. GSS’s current portfolio includes companies operating in information technology, business services, and hospitality that can deliver favorable returns for our investors.

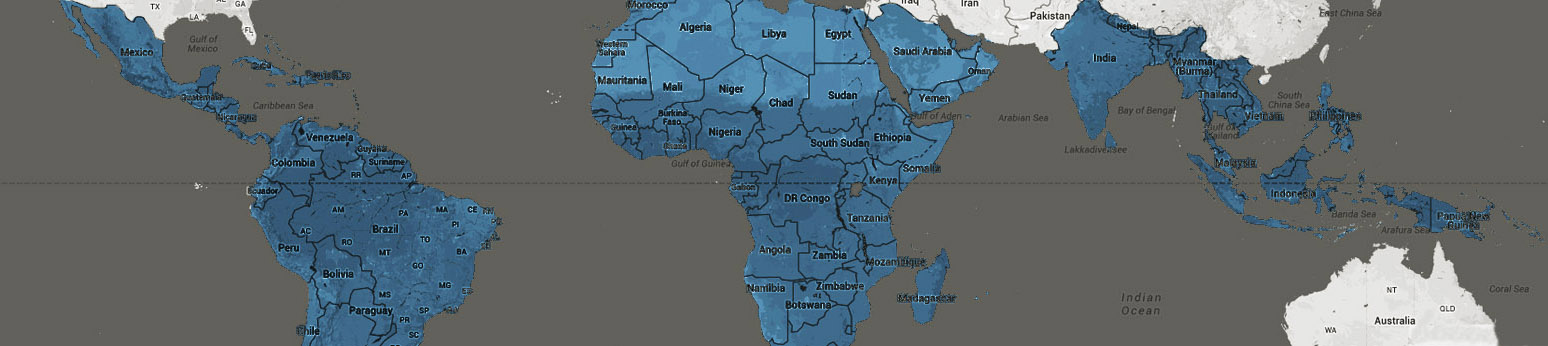

What is the Global South?

The Global South refers collectively to the nations of Africa, Central and Latin America, and most of Asia. These parts of the world are bombarded with major challenges and offer numerous business opportunities.

Opportunity through Technology

Of the 184 recognized countries in the world, the region we focus on includes almost 157. Many of these countries have severely limited resources and only 5% of the area’s population has enough food and shelter. The region lacks appropriate technology for improving the quality of life. Finding and implementing solutions in these countries offers tremendous potential for growth and change.

Our Philosophy

Private equity firms have their own personalities. Firms are built on the characters of team members, their experiences, their philosophies and the tactics they employ. In order to deliver exceptional returns, these factors must blend into a creative, streamlined operational strategy.

GSS strives to drive strong positive value to our companies and superior returns to investors. We utilize an industry focused strategy and involve high-energy, experienced, dynamic leaders in both the investment and management areas. Our customized blend of key professionals with international business experience gives us an advantage in our targeted segments. We deliver the returns that our stakeholders expect.

GSS seeks out and analyzes opportunities thoroughly and we focus on our areas of expertise. In most cases, we help build the management team of the company we invest in and continue to guide the business direction by involving seasoned business experts. We work together with the national CEOs and key team members to optimize operations, improve performance and achieve market dominance. When needed, we add new team members to strengthen the management team.

Investment Approach

Since we focus on key industries – Information Technology, Business Services, and Hospitality we concentrate on growing our network of experts in these areas. Our network of international contacts helps us address challenges quickly and provides guidance that is customized to the industry and market. Our investment professionals work with the in-house operations teams in all steps of the business procurement process – from initial due diligence through all growth stages.

Our team works beside the company’s Managing Directors and other executives to create a successful business structure. We help answer questions such as, “How do we build a sales pipeline and manage it properly? How can the finance department improve profit margins and reduce the days sales outstanding? How can we secure contracts with international companies?” GSS team members serve as an advisory board for the management teams and we provide communications to keep all parties informed.

Stage 1 Pre-Closing/Pre-Launch

Stage 2 - Start Up

Stage 3 - Growth & Operations

Stage 4 - Exit

Market Focus

In the geographical areas we target technology and service based companies offer the best prospects for value-added investing. There is a huge need for entrepreneurial firms that seek to capture market share in industries new to the areas. The GSS management team has the expertise required to effectively position innovative firms quickly and efficiently and provide the equity needed to build operations and gain market share

Geographical Market Exposure

- Africa 20%

- Asia 50%

- Micronesia 30%

Businesses Perfect for Value Creation

Unlike the operations of multi-national corporations where optimization is a costly and very complex involvement, the operations of smaller firms in selected markets can be significantly influenced by new management teams. Changes can directly influence profitability in these situations and the impact can be immediate. We craft new procedures that touch finance, HR, operations, and marketing. We have implemented plans for market expansion, crafted new sales policies, launched new branding initiatives and revamped product pricing. All of our strategies are designed to build companies and increase profitability as fast as possible.

Market Demand Creates Opportunity

The market in under-developed countries offers high growth and sizable market share, especially in the technology area. The need for all forms of technological support will increase dramatically as economies improve and as outside firms establish new offices and manufacturing facilities in these countries. Typically, private equity firms have been slow to enter these markets, but GSS is involved in start-ups and established businesses with proven technology, experienced teams and strong revenue models. Since there are fewer firms involved, there are reasonable valuations and opportunities for strong returns.

Investment Criteria

GSS diligently searches for companies that have strong business growth potential if the right management and operational teams are combined with a targeted industry approach.

We focus on attractive, niche companies. The companies we seek must have attractive risk-adjusted returns that are not reliant on debt. We look for market demand, scale advantages, limited competition and industry growth factors.

GSS Investment Criteria:

Meets financial criteria

Growth equity investments, traditional buyouts and leveraged build-ups

Control or shared-control positions

Three to five-year investment holding periods